WH Smith (LSE: SMWH) is a dividend stock that hasn’t done much growing in recent years. In fact, it’s 58% lower than before the pandemic struck in early 2020!

However, that hasn’t stopped activist investor Palliser Capital from building a near-5% stake in the FTSE 250 retailer. And according to a Sky News report, Palliser reckons there’s scope for the shares to nearly double over the next three years!

What we know

Established in 1792, WH Smith is synonymous with the British high street. However, that business was sold to Modella Capital for £76m in March, leaving WH Smith as a pureplay global travel retailer. The brand name was not part of the deal.

Palliser Capital sees an attractive growth opportunity in international travel. Founder and chief investment officer James Smith told Reuters: “While its [WH Smith’s] travel business has grown strongly in recent years… its share price is still around Covid-19 levels and has consistently underperformed the broader Travel & Leisure and Retail sectors.”

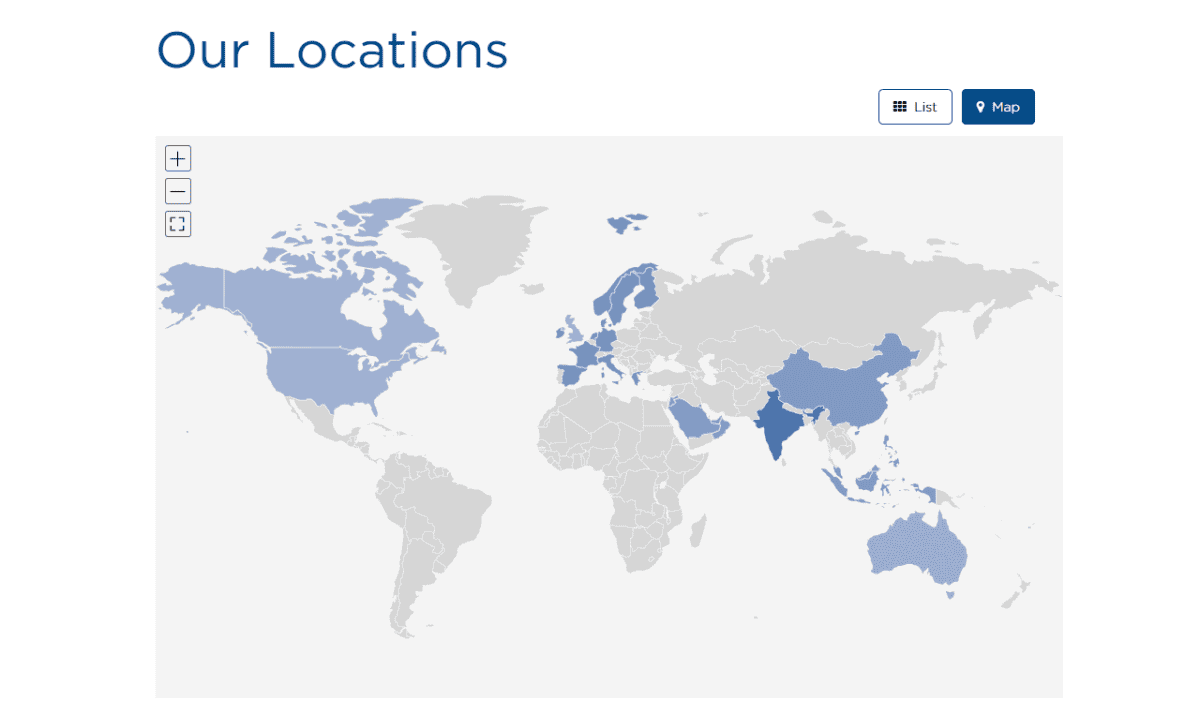

The firm already operates some 1,300 stores in train stations, airports and hospitals across 32 countries. They’re in the UK, US, Europe, Asia, Middle East, and Australia. It also owns InMotion, the largest airport-based digital accessories retailer in North America.

Is it growing?

The company recently released a trading update covering the 13 weeks to 31 May. UK like-for-like (LFL) sales in airports were up 7%, hospitals increased 3%, and railway sales were 6% higher. North America grew 7%, as did its Rest of the World business (12% in constant currency).

WH Smith continued to increase its global footprint through 10 new stores in airports, including Calgary, Denver, Detroit and Washington. It also refitted seven stores at Edinburgh airport, including a Smith’s Family Kitchen café.

Looking ahead, management sees substantial growth opportunities in the US, which is the world’s largest travel retail market. Meanwhile, global passenger numbers are expected to double over the next 20 years, necessitating heavy investment in airport infrastructure. So there should be plenty more airport retail opportunities ahead.

Valuation

When WH Smith still had the high street shops, the stock didn’t appeal to me. That’s because the painful decline of traditional British high street retail seems unstoppable, sadly.

But it’s a different matter with the travel outlets. I recently had to queue for nearly 15 minutes in a WH Smith to get a snack for a train journey, while the store in my local airport was packed with people buying books, sunglasses, and more for their holidays.

Airport travellers are a captive audience — they have time, limited options, and often buy things impulsively. I know I did, as I randomly found myself purchasing a magazine from WH Smith for my flight — and it wasn’t cheap!

One risk I see here though is that the company is carrying quite a heavy debt load, with net debt of £1bn. This is currently manageable, and the balance sheet is reportedly one area that activist investor Palliser wants to improve. Still, it’s an issue worth bearing in mind.

On the plus side, the stock is trading on a cheap forward price-to-earnings ratio of 12.4, while offering a 3% dividend yield. Given WH Smith’s large global travel opportunity, I think this value-growth stock is worth considering at 1,121p.